The picture above is a misfit. And no. It's not to be sarcastic. The notion of 'INVESTING' in debt securities in Indian context being - NOT for steady income earners, less so for entrepreneurs or for the risk seeking; is deep rooted in the psyche of Indian investors, new or seasoned.

India is a market for high income earnings, for risky assets - equities, F&O, commodities, cryptos, real estate plots near upcoming airports. Fixed income or debt investing may be for old folks, retired people who have nothing better to do than to keep looking at FD's or monies saved for 40+ years so that savings kitty does not oscillate the way values do on the mobile wealth Apps.

Fixed income swing traders in the west, chasing double digit returns are pretty normal; here in India returns from high yield instruments, junk bond kings and stress asset investing is still at a nascent stage, if not altogether absent. So, is there is money to be made in fixed income?

Hell yeah!

Pay Attention to the long duration debt... for starters!

The level of free information in the world and in India is a boon for the current generation and any business newspapers such as The Hindu Business Line offer minefield of information on weekly basis on various asset classes.

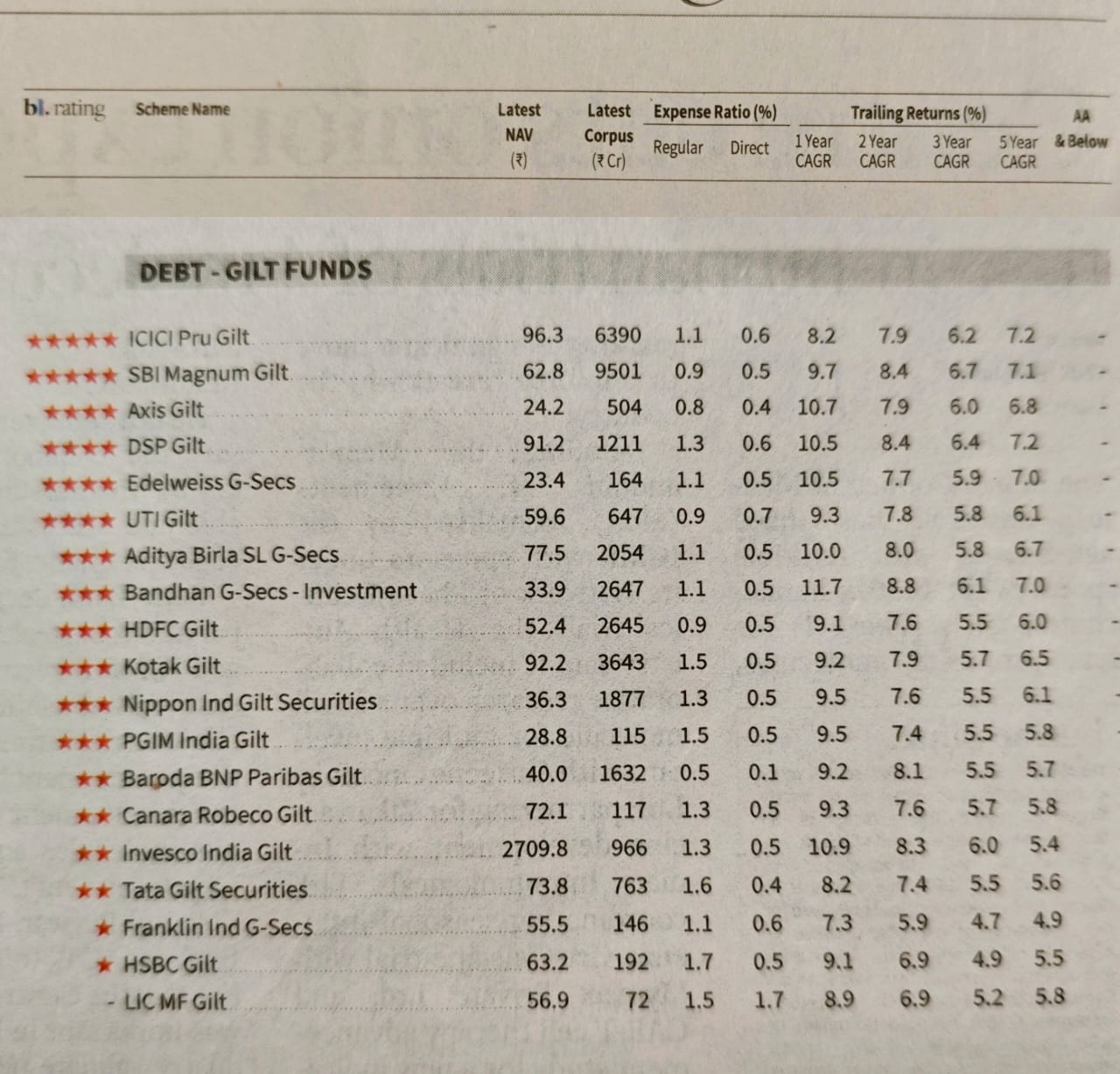

On a typical Sunday edition, we have data on how fixed income funds and securities have done over varied time periods.

Interesting data on how the performance of fixed income securities and funds have done.

Source: Business line edition SEP 15,2024

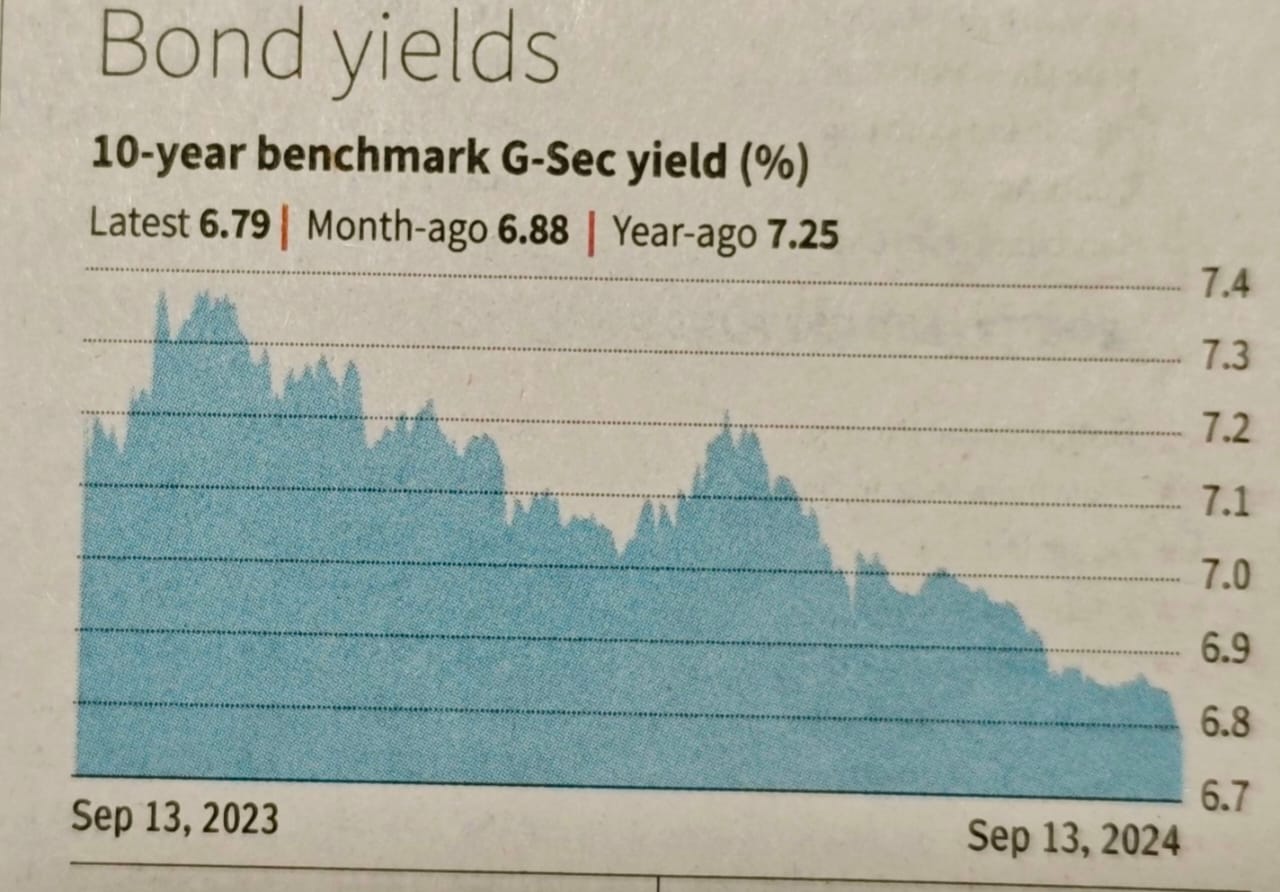

On a 1-year basis, the returns from fixed income funds touched double digits already and we believe that discussion on macro matters that has been happening from the expert community then it looks like the party may be entering a frenzy zone over the next 6-12 months.

While the excitement in the equities continues, it might still be prudent to invest in the less preferred cousin of equity, the fixed income security. What lies ahead might just surprise us over the next 12-15 months.

Finally, you just wanna make like 15% annual returns, right? Or more!